Buckle Up: Markets Prepare for Volatile Week with Short-Term Bearish Signal

The link you provided discusses short-term bearish signals in the market as investors brace for a news-heavy week. In this article, we will delve deeper into the factors contributing to the bearish sentiment and explore the implications for investors.

Market Volatility and Uncertainty

One of the key reasons for the short-term bearish signal in the market is the heightened volatility and uncertainty surrounding various economic factors. Events such as geopolitical tensions, trade disputes, and changes in monetary policy can significantly impact market sentiment and trigger sell-offs.

Investors are now grappling with a wide range of uncertainties, from the ongoing trade tensions between major economies to central banks’ decisions on interest rates. This uncertainty has created a risk-off sentiment among investors, leading to a decline in stock prices across different sectors.

Economic Indicators and Data Releases

Another factor contributing to the bearish signal is the upcoming release of important economic indicators and data points. Market participants are closely monitoring key reports such as employment figures, GDP growth, inflation data, and consumer sentiment surveys to gauge the health of the economy.

Any surprises or deviations from market expectations in these reports could lead to increased volatility and further downside pressure on stock prices. Investors are particularly wary of data releases that could indicate a slowdown in economic growth or a decline in corporate earnings, as these factors could negatively impact market sentiment.

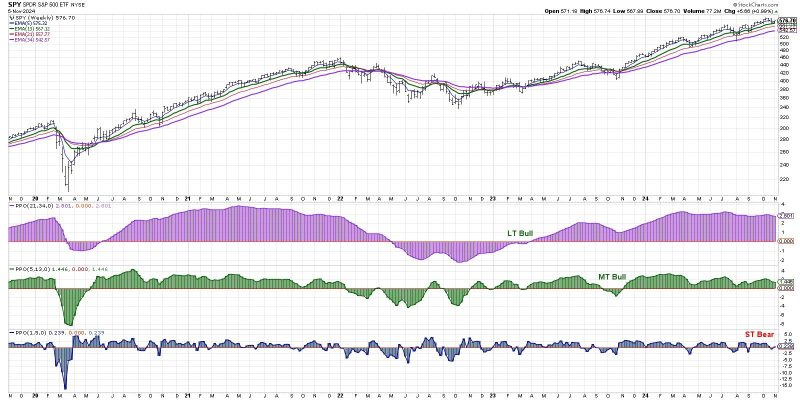

Technicals and Sentiment Analysis

Technical indicators and sentiment analysis also play a crucial role in shaping market dynamics. Traders often rely on chart patterns, moving averages, and other technical tools to identify potential trend reversals and turning points in the market. In addition, sentiment analysis, which gauges investors’ mood and confidence levels, can provide important insights into market sentiment.

Currently, technical indicators are showing signs of weakness, with many stocks and indices trading below key support levels. This suggests that investors are adopting a cautious stance and are likely to sell off their positions in the event of negative news or developments.

Risk Management and Portfolio Strategies

Given the uncertain market environment and the prevalence of short-term bearish signals, it is crucial for investors to prioritize risk management and adopt sound portfolio strategies. Diversification, setting stop-loss orders, and regularly rebalancing portfolios can help mitigate potential losses and navigate volatile market conditions.

Investors should also stay informed about key economic events and news releases that could impact the market. By staying proactive and staying ahead of market trends, investors can position themselves to capitalize on opportunities and protect their portfolios from downside risks.

In conclusion, the short-term bearish signals in the market highlight the importance of vigilance and risk management for investors. By closely monitoring economic indicators, technical signals, and market sentiment, investors can make informed decisions and adapt their strategies to navigate choppy waters in the market.