In today’s ever-evolving global economy, the USD remains a crucial player and its performance is closely monitored by governments, financial institutions, and investors worldwide. There has been much speculation in recent times regarding the potential for a significant rally in the value of the USD. The US Dollar has exhibited notable strength against other major currencies, and several factors are contributing to a possible upsurge. This article delves into the current economic landscape and the key elements that suggest the USD may be setting up for a perfect rally.

One of the primary drivers behind the potential rally of the USD is the Federal Reserve’s monetary policy. The Federal Reserve, the central banking system of the United States, plays a pivotal role in shaping the country’s economic environment by adjusting interest rates and influencing the money supply. In response to the economic challenges posed by the COVID-19 pandemic, the Federal Reserve has implemented various measures to support the economy, including slashing interest rates to historically low levels and injecting liquidity through asset purchases. The loose monetary policy pursued by the Fed has led to a weaker USD in recent times. However, as the US economy shows signs of recovery and inflation expectations rise, the Fed may shift towards a more hawkish stance by tapering its asset purchases and raising interest rates. Such actions are typically viewed as positive for the USD, as higher interest rates attract foreign capital and strengthen the currency.

Geopolitical factors also play a significant role in shaping currency movements, and recent developments have favored the USD. The ongoing trade disputes between the United States and China, as well as uncertainties surrounding Brexit and the European Union, have led investors to seek safe-haven assets like the USD. In times of global instability, the USD tends to benefit from its status as the world’s primary reserve currency and a safe refuge for investors seeking stability. Furthermore, the relative strength of the US economy compared to other major economies has bolstered the USD’s appeal. Despite its own set of challenges, the United States has demonstrated resilience and flexibility, attracting capital inflows and reinforcing the value of the USD.

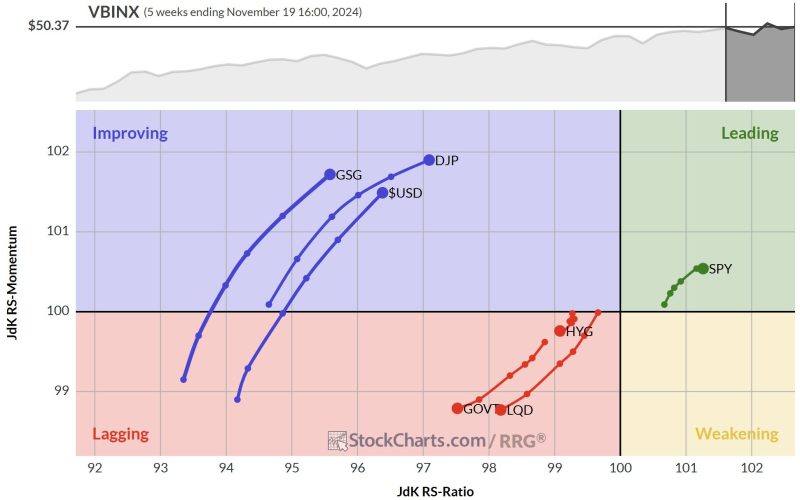

In addition to these macroeconomic factors, technical analysis also points towards a potential rally in the USD. Chart patterns and trends indicate that the USD may be poised for a breakout, with key resistance levels being tested and potential bullish indicators emerging. Traders and analysts closely monitor these technical signals to time their positions and capitalize on potential movements in the currency markets.

However, it’s essential to acknowledge the inherent volatility and uncertainties in financial markets. The global economic landscape is constantly evolving, and unforeseen events can quickly alter the course of currencies. While the USD may be setting up for a rally based on current indicators, it is crucial to exercise caution and closely monitor developments that could impact its trajectory.

In conclusion, several factors suggest that the USD may be gearing up for a significant rally in the near future. The Federal Reserve’s monetary policy, geopolitical dynamics, and technical analysis all point towards a potential strengthening of the USD. As investors navigate the complex terrain of the currency markets, staying informed and adapting to changing conditions will be paramount in seizing opportunities and mitigating risks in the pursuit of financial success.